Outlook on a New Decade for Insurance

by Angus MacCaull

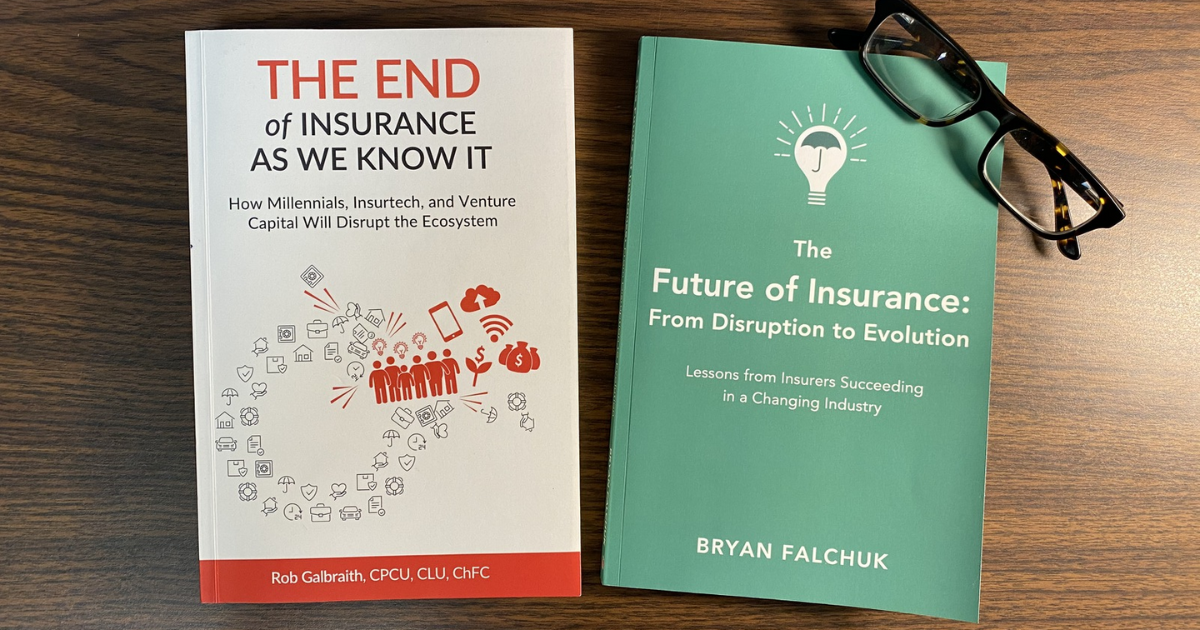

In the 2010s there was a lot of worry about disruption in the insurance industry. New technology changed customer expectations and challenged the way we do things as a relationship-based business. InsNerds even published a book by Rob Galbraith called The End of Insurance as We Know It.

But the mood shifted this year as we entered the 2020s. Just as the global pandemic began shifting business practices across North America, InsNerds published The Future of Insurance: From Disruption to Evolution. This new book by Bryan Falchuk contains case studies of digital transformation at seven carriers that actually pre-date the pandemic. It shows that the industry has been learning—and COVID-19 has only accelerated our education.

Insurtech startups and venture capital are indeed still presenting new business models. Lemonade in particular has shown that loss ratios don’t currently matter to a certain class of investors. And Tesla recently made a high profile entry into insurance.

But many insurtechs have reconsidered their goal of replacing parts of the insurance ecosystem (including brokers like ourselves at AA Munro). They are now looking to work with existing parts of the industry to improve the experience of buying, selling, and servicing insurance for everyone.

Falchuk offers three key takeaways for organizations that want to be part of the future of insurance. These are presented in light of his research with carriers, but the principles apply to brokers and vendors as well.

Takeaway #1: Customers Hold The Answer

Customers don’t really want insurance, so putting their perspective first can be complicated. Ask a customer and they’ll quite naturally say they want everything covered pretty much for free. They don’t understand how insurance works. No one likes to think of themselves as a financial risk, so customers have been sometimes been left out of the picture by experts when creating insurance products and services. This is a problem. Because customers are the experts on how insurance feels.

Takeaway #2: Engage Your People

This is where the rubber hits the road. Where theory meets practice. Where a good plan has the possibility of great execution. “Regardless of the context, every success story hinges on the work of employees who feel empowered and engaged by their company’s evolution,” Falchuk writes. “That is how culture is shifted to create lasting change and lasting ability to change.”

Takeaway #3: Be Focused on Intention, Outcome & Time

Insurance is a quirky industry. On the one hand it’s supposed to be best when it’s boring. We don’t actually want claims to happen, because that means hardship in our customers’ lives. But on the other hand, there’s a Shiny New Thing every month. Articles, conferences, software products promising to make us better than our competitors. A crucial ability for organizations interested in the future of insurance is to see decisions through while still staying open to new input.

Leave a Reply